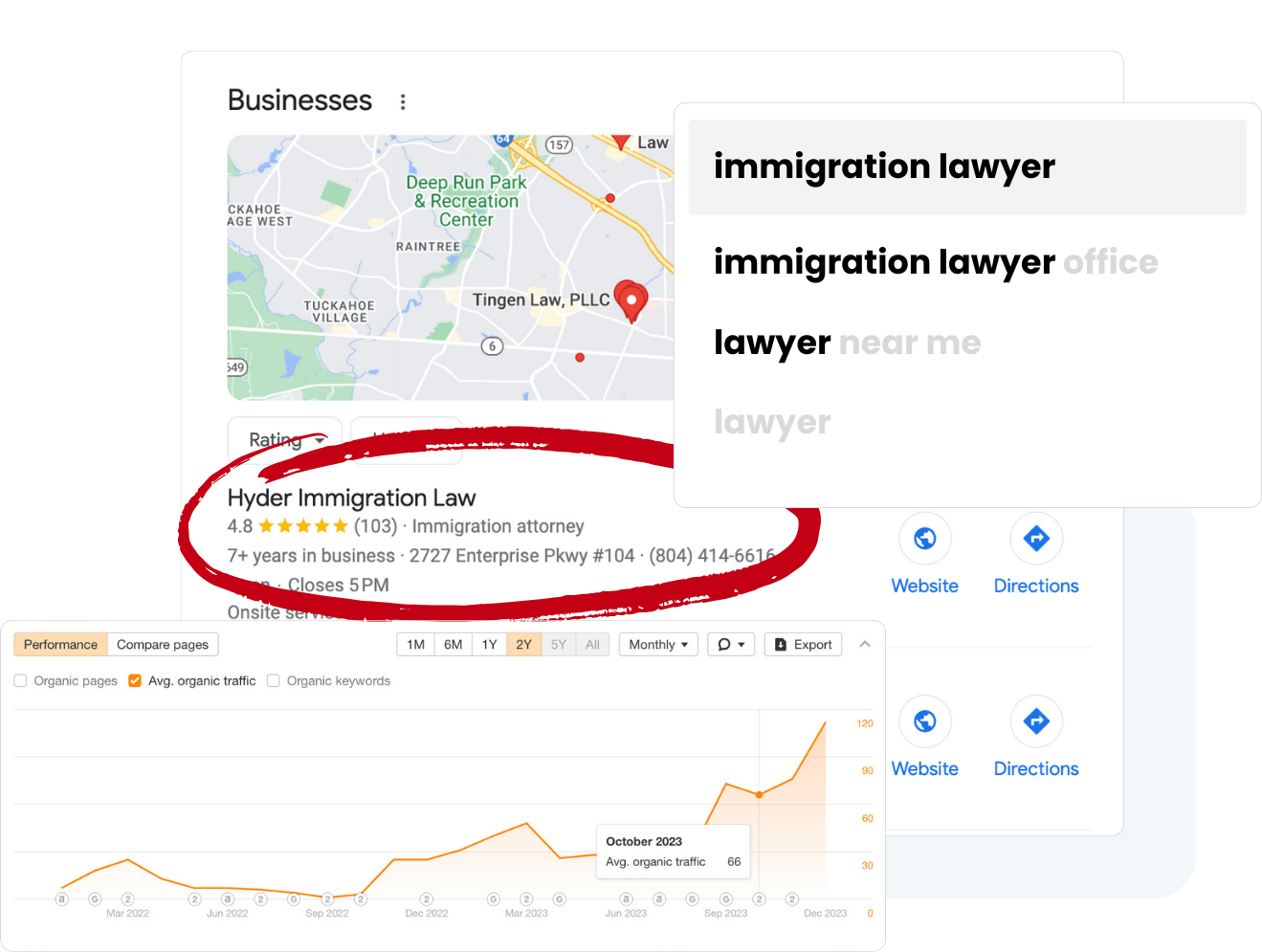

Map Ranking

We help local businesses rank higher on Google Maps, get more reviews, and expand their territory (be on multiple cities, even when your potential client is farther than 10 miles away).

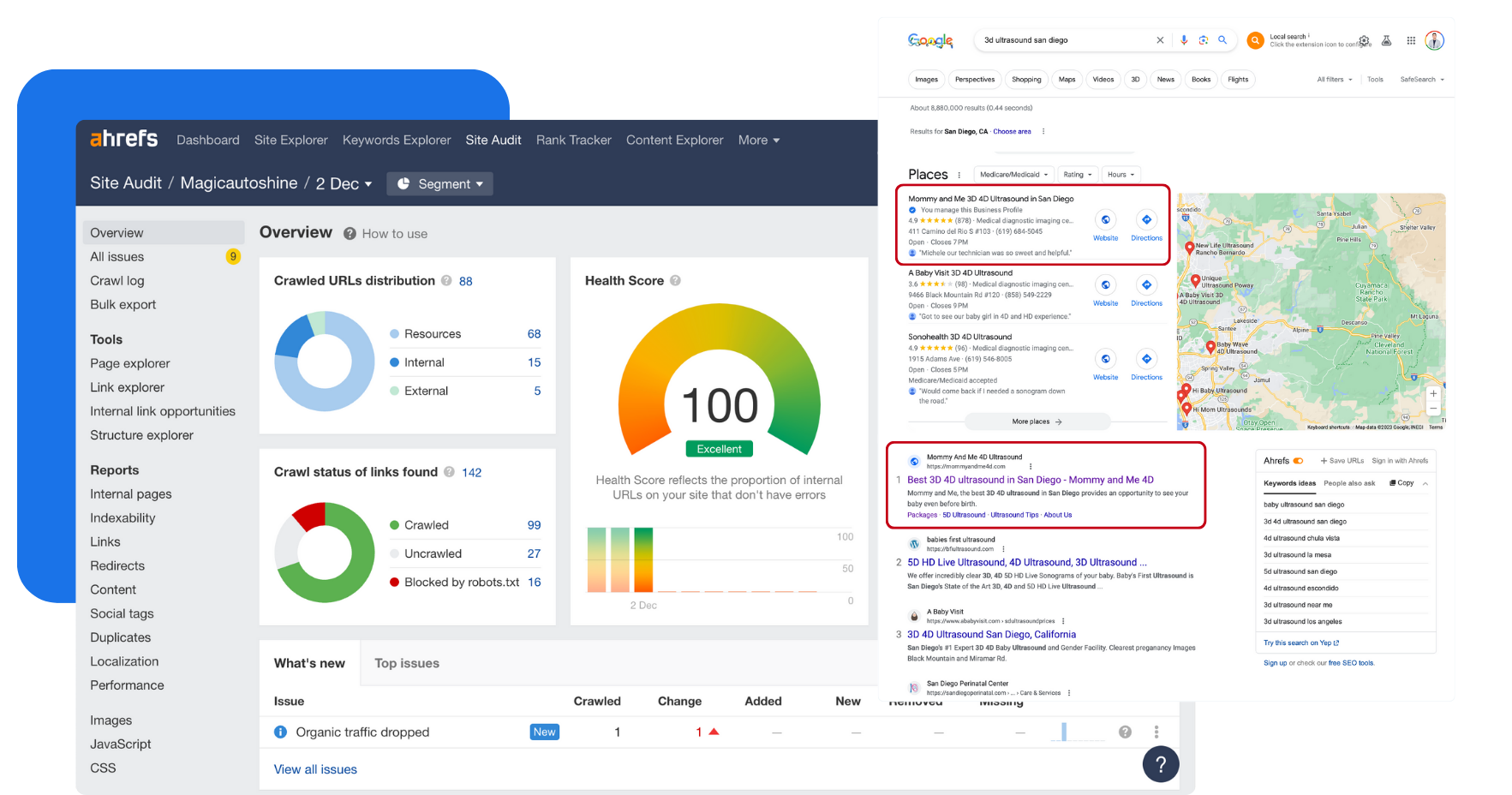

Rank Higher on Google Maps

Local SEO starts with a fully optimized and managed website and Google Business Profile. We understand Google’s algorithm and optimize the features of your online presence that influence your rankings and conversions.

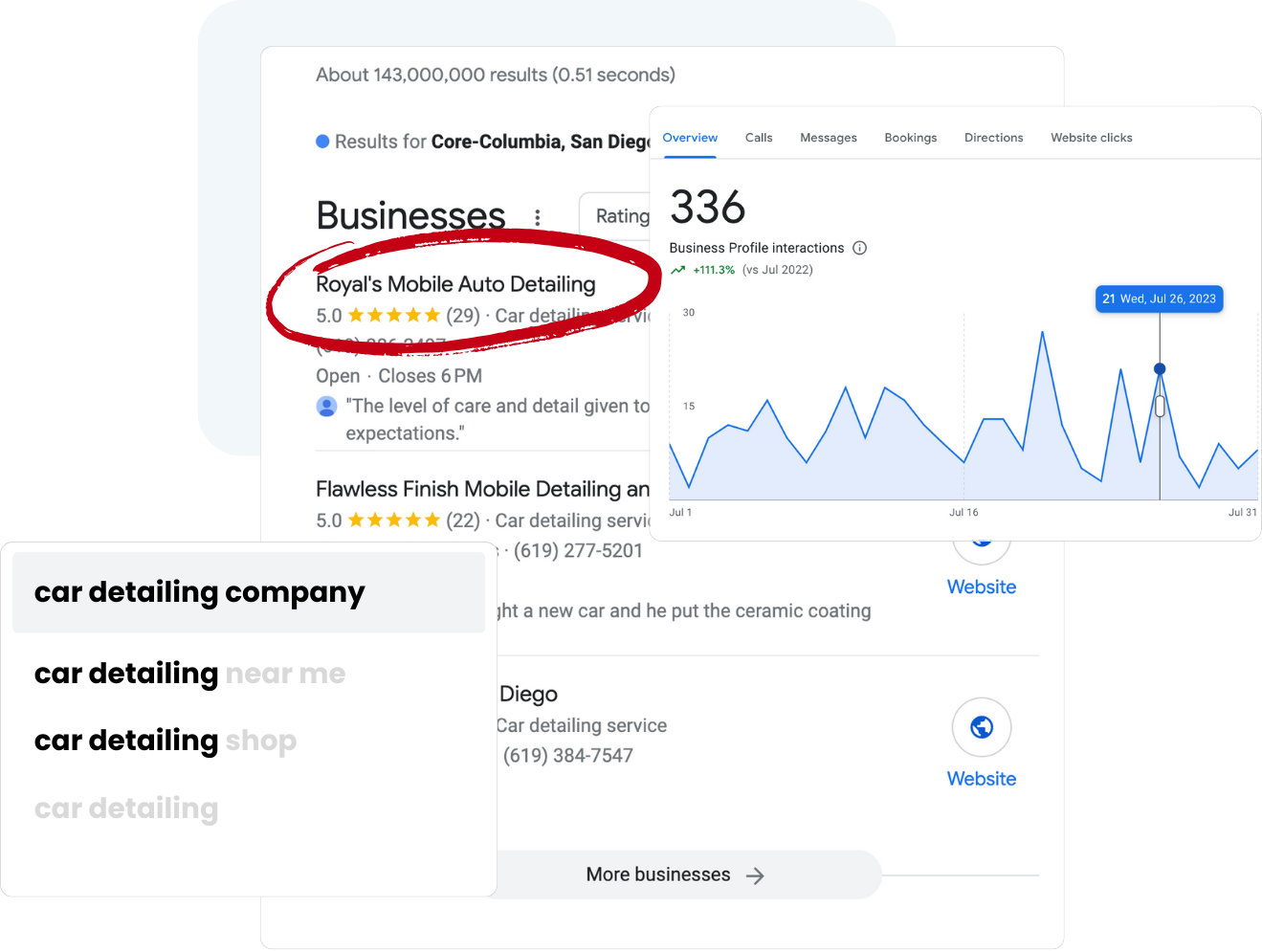

Territory Expansion

People search on Google for businesses like yours every single day, but they may not find you if they are more than 10 miles away. Map Ranking will help you rank higher, and in more cities around you so that you can capture more new customers.

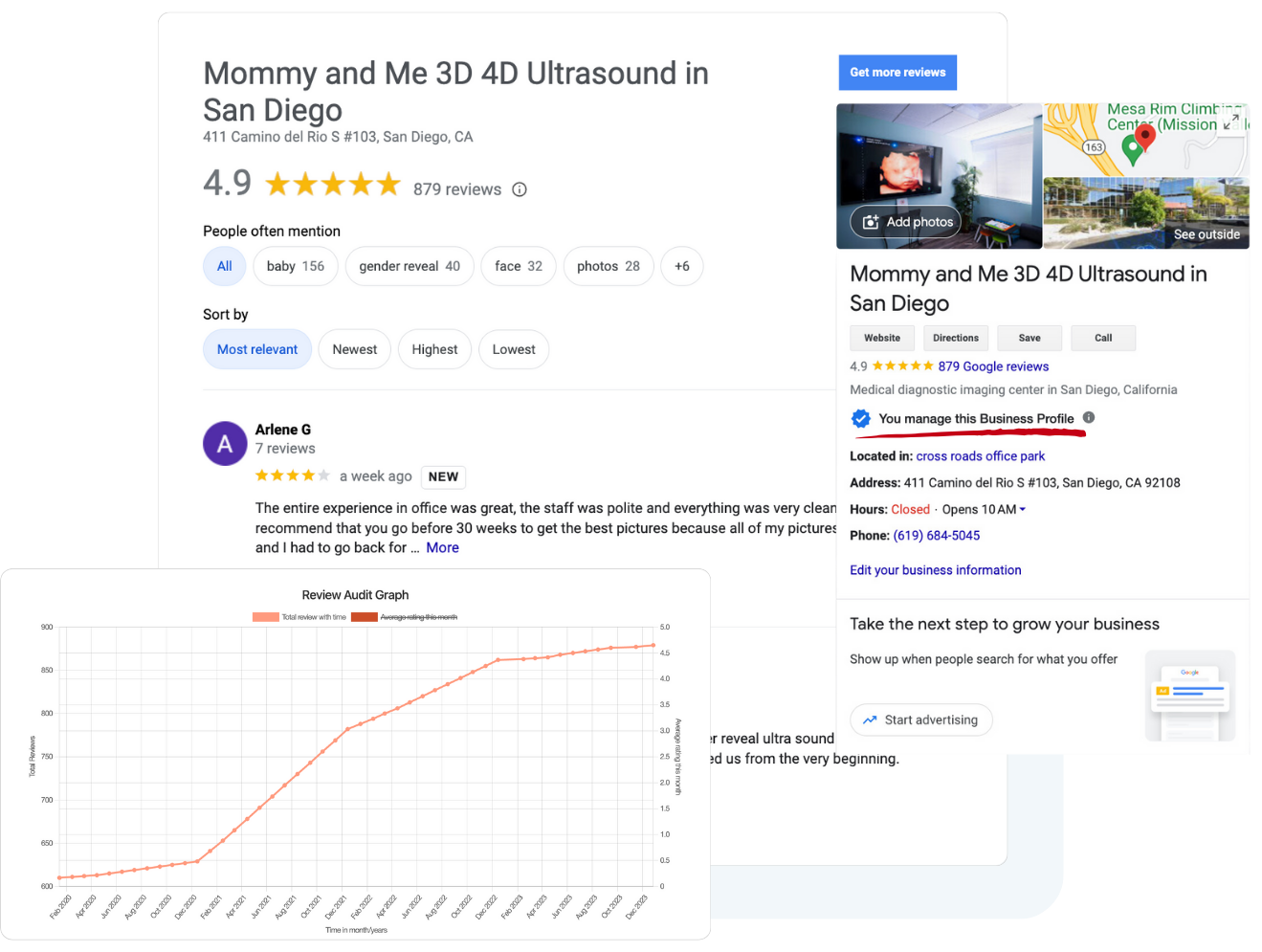

Get More Reviews

Reviews are critical to increasing both rankings and conversions. Map Ranking’s automated review generation software will help you generate a new 5-star review every single time that you have a happy client.

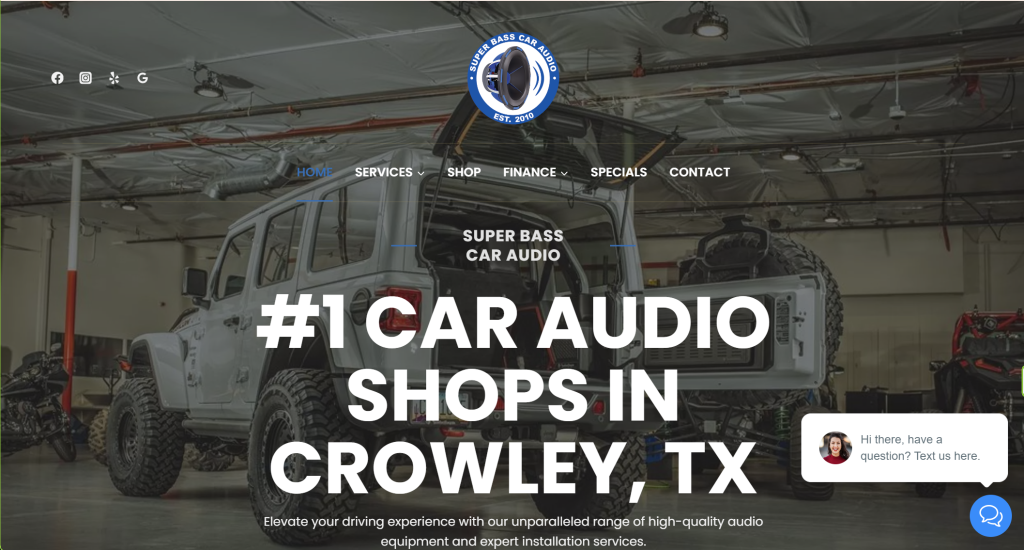

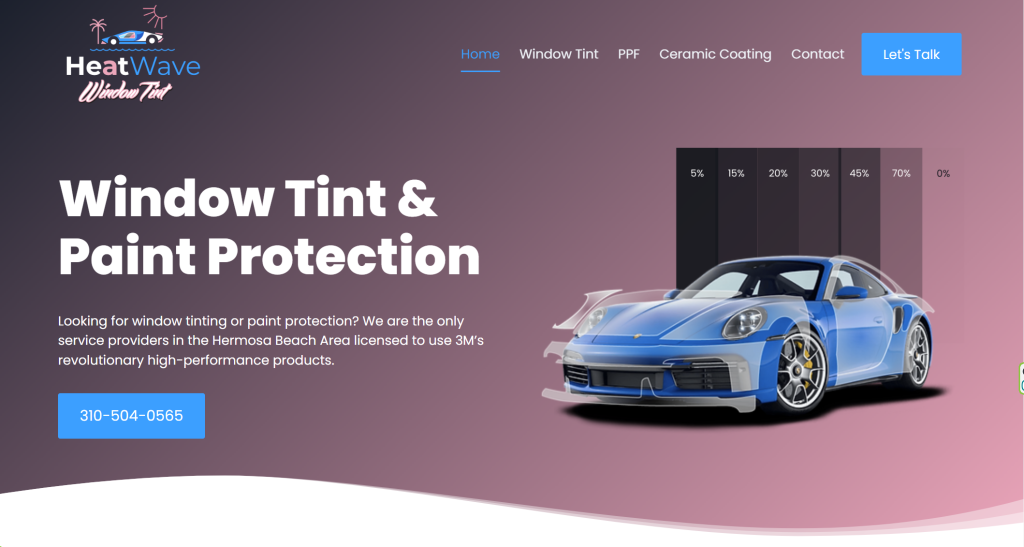

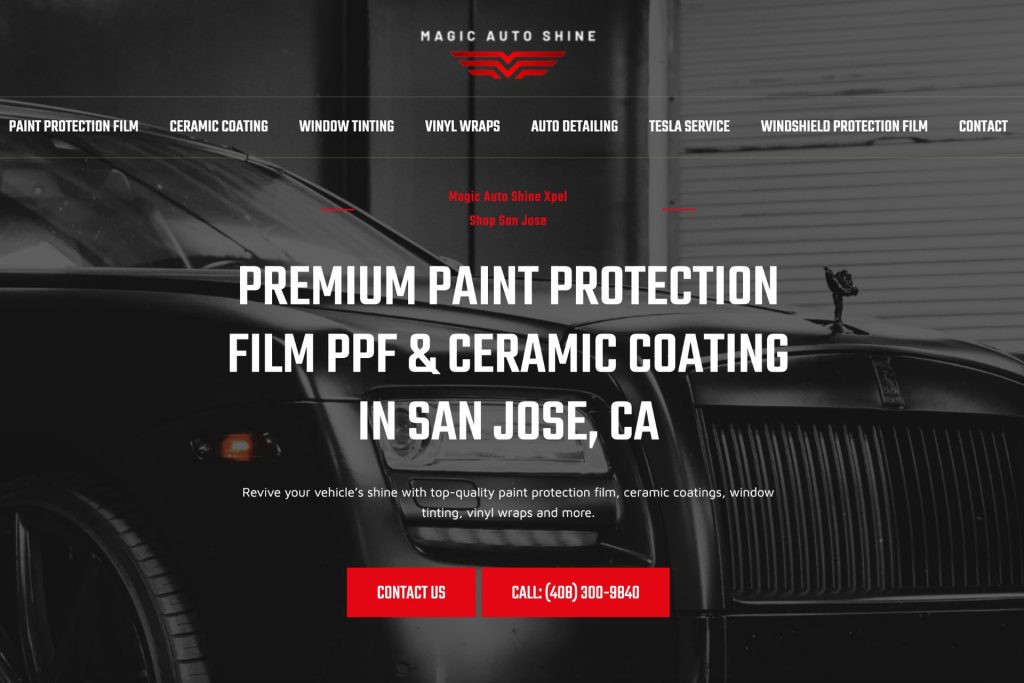

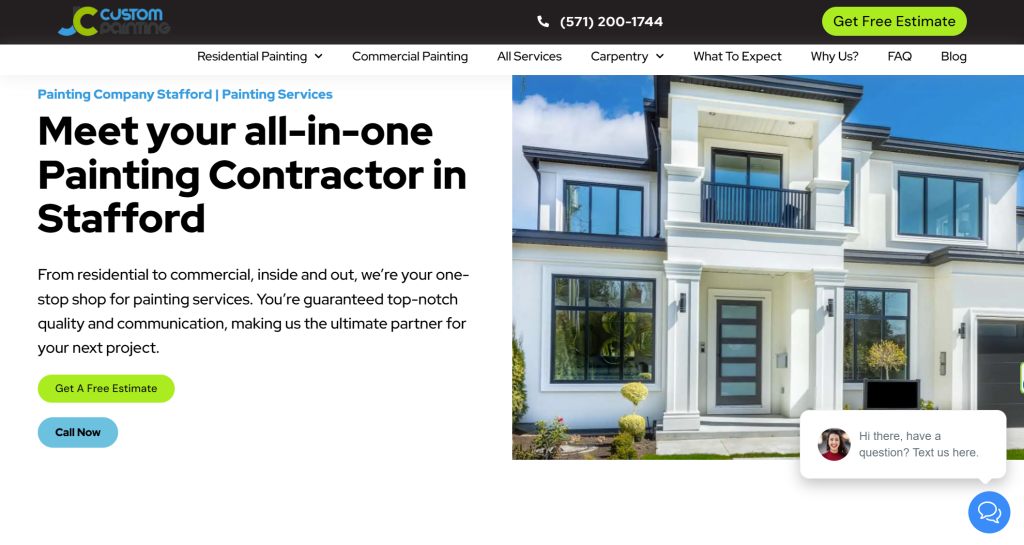

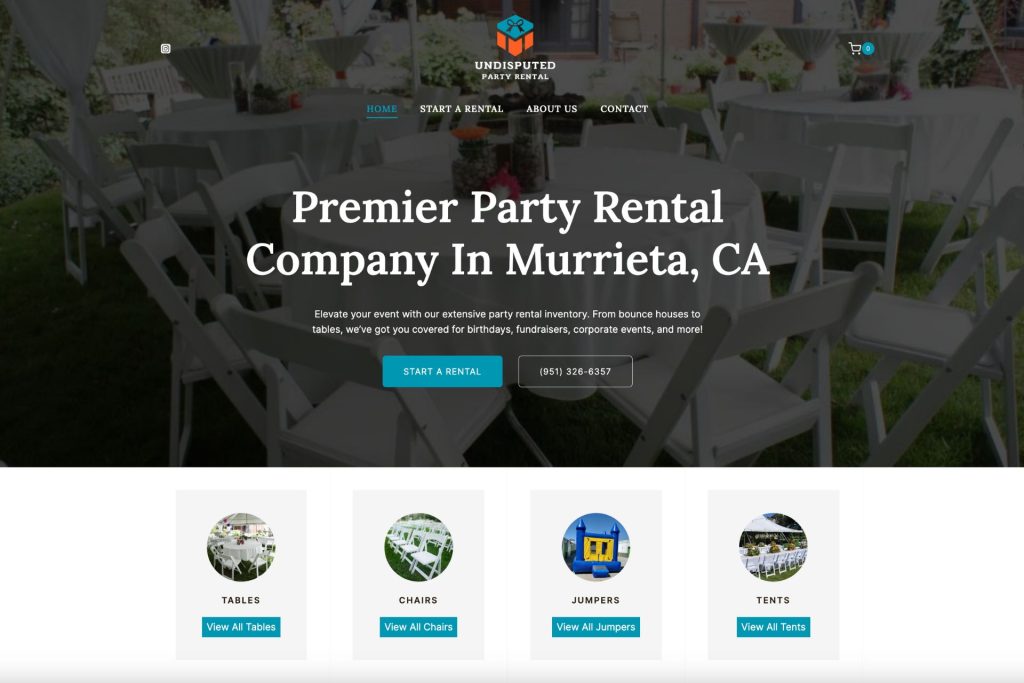

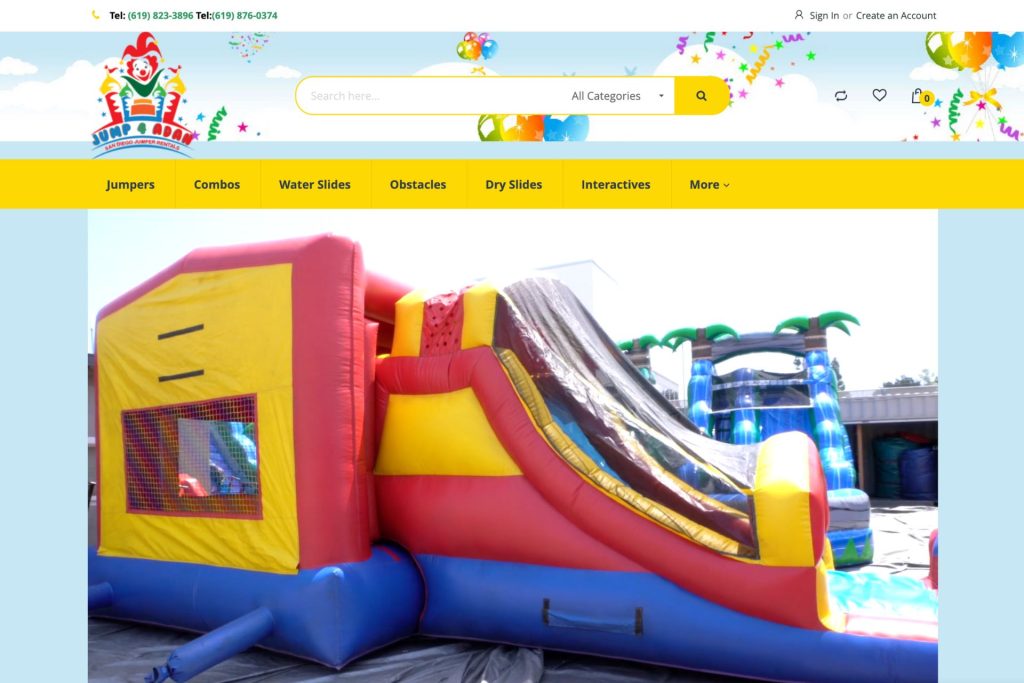

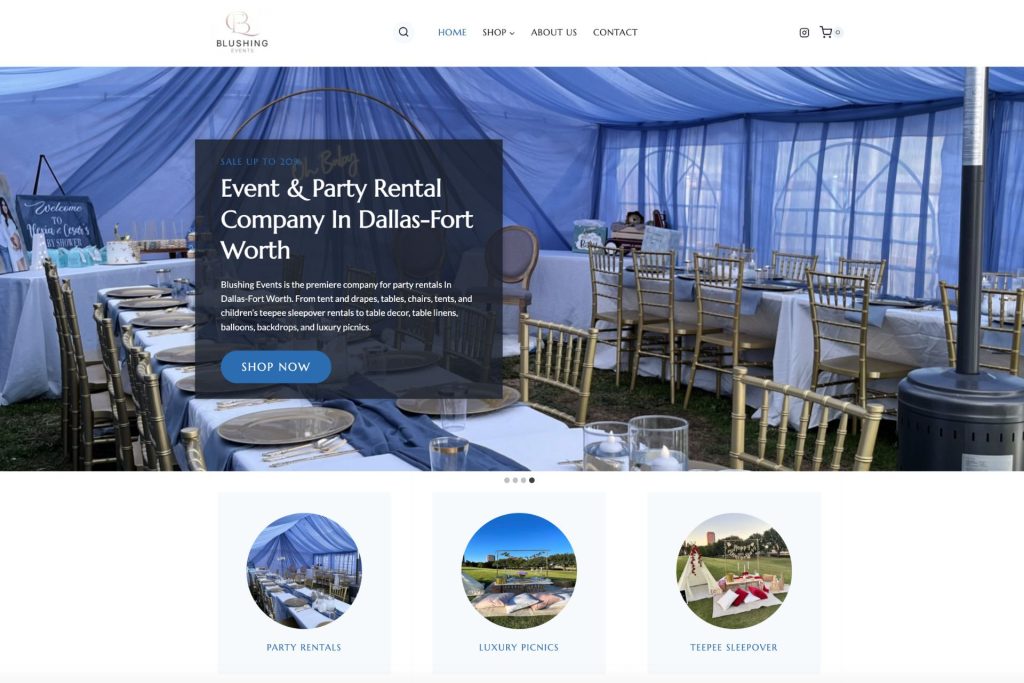

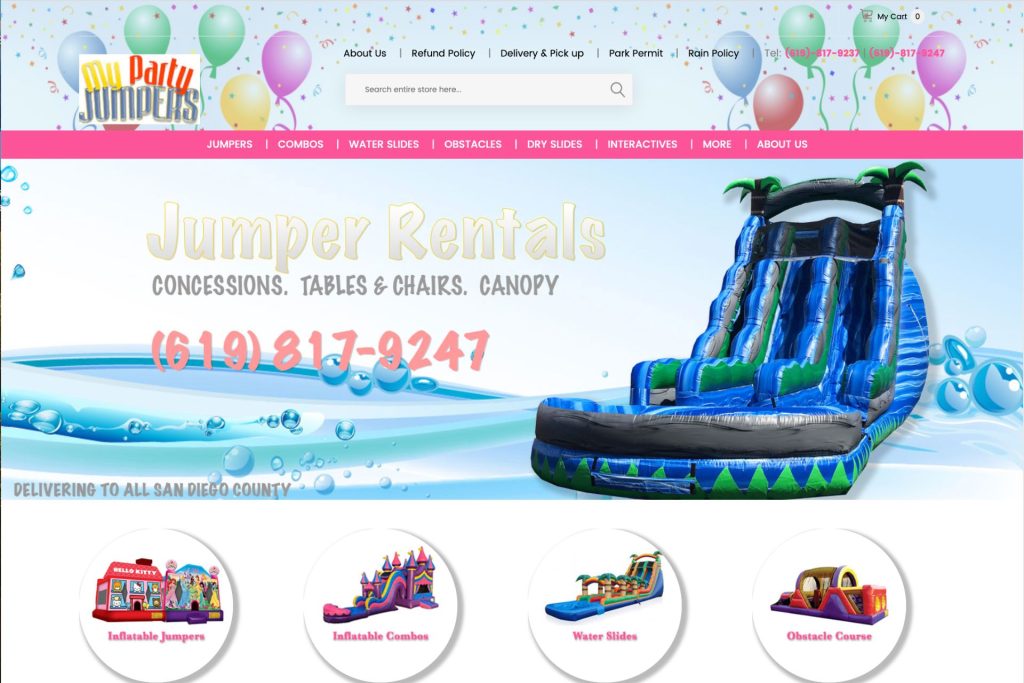

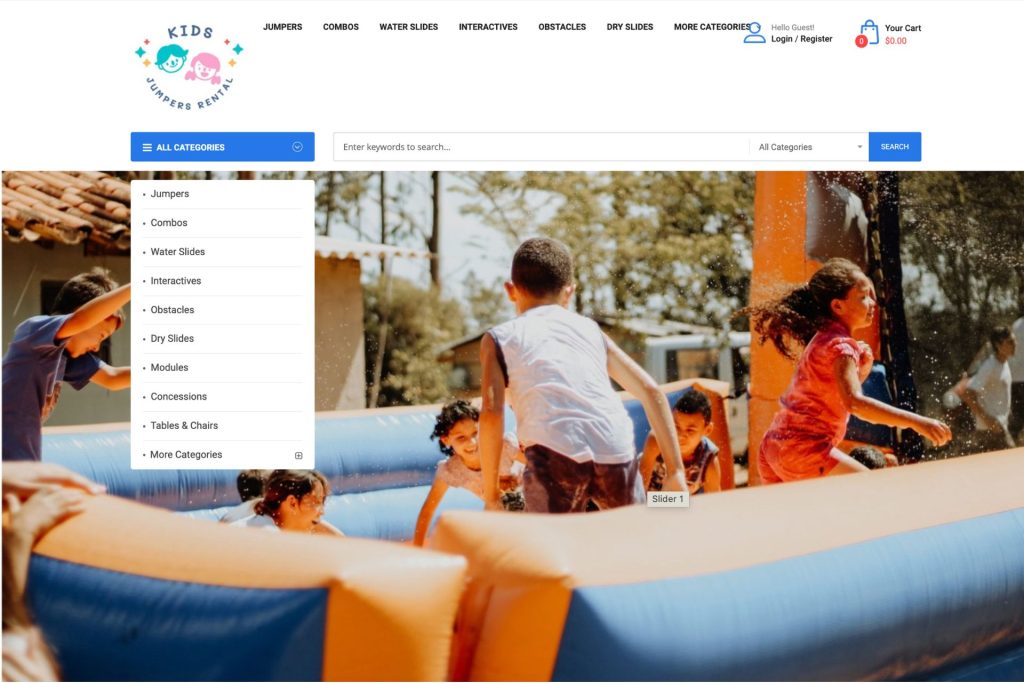

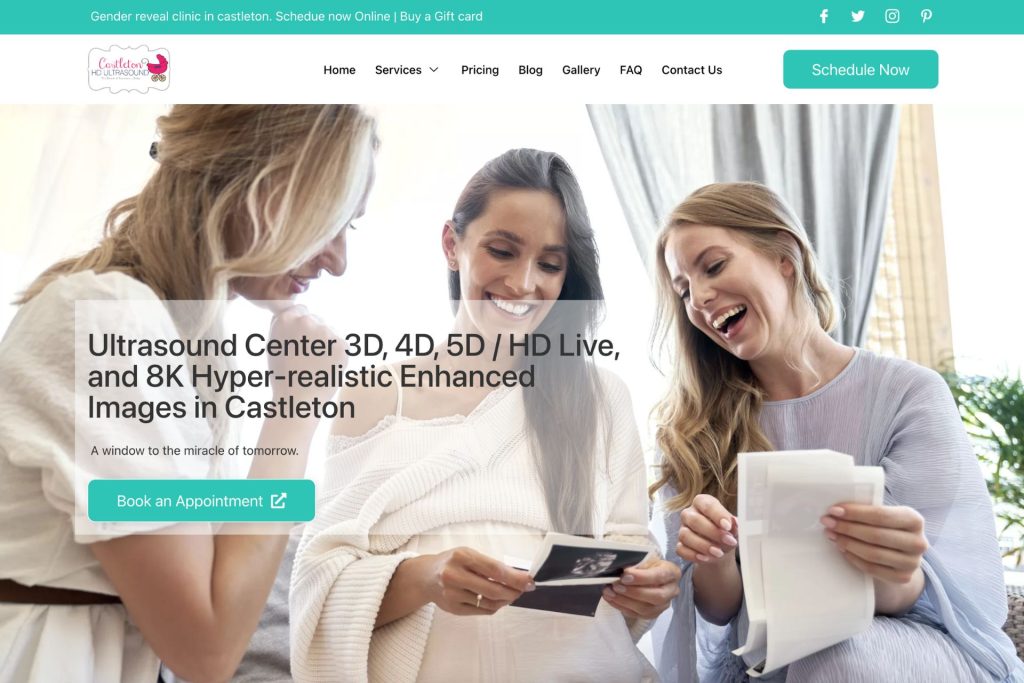

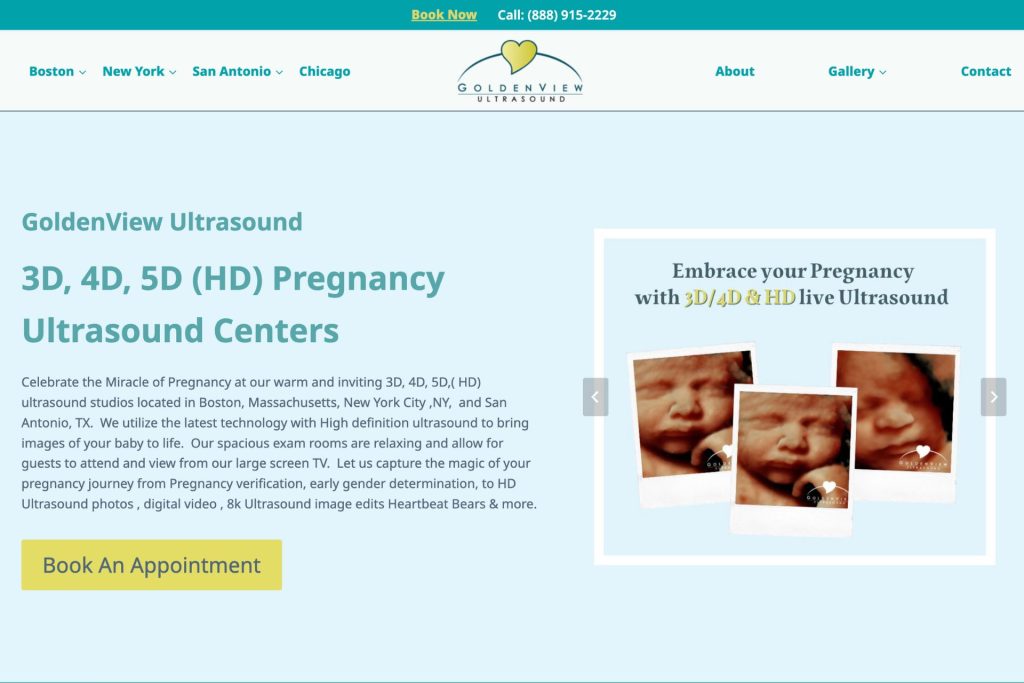

Map Ranking Web Design Services

Websites that will create instant impact. Customers and consumers shop with their eyes first. Its very important to have a professional and modern site for your business.

We Create Websites That Convert

Create a professional and mobile responsive website or landing page that converts like crazy.

Rank Higher Google Maps

Unlock the power of visibility with our comprehensive Google Maps SEO service. We optimize your website to climb search rankings and attract organic traffic. Drive growth and reach your audience effectively with our tailored SEO solutions.

Map Ranking Territory Expansion

People search on Google for businesses like yours every single day, but they may not find you if they are more than 10 miles away. Map Ranking will help you rank higher, and in more cities around you so that you can capture more new customers with our Google Maps SEO (local SEO) services.

Why Choosing

Map Ranking

Map Ranking’s local SEO and client management software has everything you need to succeed on your own! Plus, we are here to help when you are ready to grow or too busy running a thriving business to handle marketing solo.

MOBILE APP

Access your CRM on the go, manage contacts, and stay connected with customers using our user-friendly mobile app.

Call Tracking

Monitor and analyze calls to understand customer interactions, improving communication and enhancing service quality.

Missed Call Text Back

Automatically send a text message to callers you missed, ensuring no customer inquiry goes unanswered.

Booking & Appointments

Easily schedule and manage appointments, enhancing efficiency and providing a seamless booking experience for your clients.

Live Website Chat

Engage with website visitors in real-time, answering queries instantly and fostering a proactive customer support approach.

Review Generation

Make leaving a review for your business easy, contributing to a positive online reputation for your business.

No contracts! Cancel Any time

Google Maps

Map Ranking Results Guaranteed

Try Map Ranking risk-free and see a boost in rankings and clients or get 100% your money back!

30 days money back guaranteed.